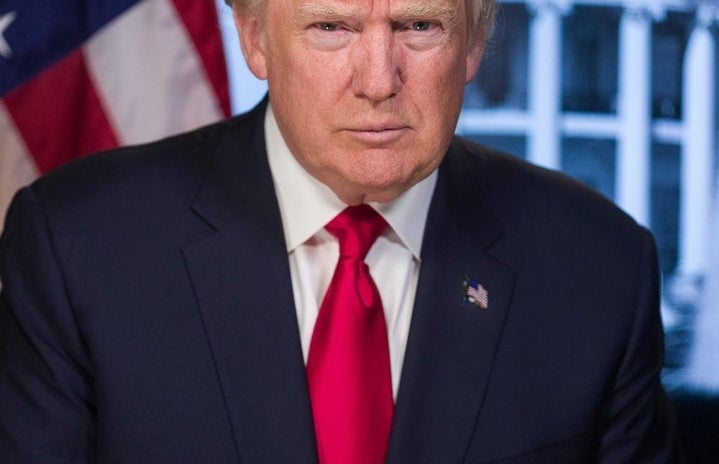

Once more, Donald Trump’s finances have taken over the news cycle. On September 27th, The New York Times published an extensive report of Donald Trump’s tax returns spanning over more than the past twenty years. This report, however, is several pages long, so if you don’t have the time to read it all, allow us to provide you with a short summary.

Recently, The Times was able to obtain President Trump’s federal tax returns from an unidentified source (neither the records themselves nor the source was given to protect the informant), revealing that Donald Trump has only paid $750 in income tax over the past two years. Even more astoundingly, the report also found that over ten of the last fifteen years, Trump has paid no income taxes at all. This comes as a shock to many, despite the fact that the public has known this for quite some time that Trump is quite proud of his ability to avoid taxes. In a 2016 debate, he even bragged about it, saying that it “makes [him] smart.” However, the question of how he managed to pull off this feat while claiming to be one of the world’s most successful businessmen still looms. To fully understand it, one must look back to Trump’s days on The Apprentice.

After working on the popular show, Trump came into a substantial amount of money, which he immediately spent on what The New York Times called a “spree of quixotic overspending.” He began investing in many businesses, particularly golf courses, that proceeded to hemorrhage money, casting him into debt. For the past fifteen years, he has reported losing far more money than he has taken in, thus allowing him to not pay any income tax, or pay significantly less than he should. Had he not found legal loopholes, The Times reports Trump may have had to pay upwards of $100 million. However, Trump has not completely gotten off the hook. He has many partial loans (totaling at around $300 million) that are due within the next four years.

The returns also shed light on the fact that Trump has been involved in shady activities regarding his businesses and presidency. He never divested himself from his business — something many presidents do to ensure there is no connection between their own wealth and the White House’s. Trump has taken a much different approach, which has resulted in some questionable occurrences. For example, In 2017, the Billy Graham Evangelistic Association paid $397,602 to one of Trump’s hotels during the group’s World Summit in Defense of Persecuted Christians.

President Trump has also suffered losses at the hands of the IRS, and is still currently in the process of being audited. In 2009, he declared he was “hereby abandoning” his stake in his failing Atlantic City casinos, allowing for him to walk away with no prior losses, but also no ability to gain from the business. This deal was essentially all or nothing. Trump was not left completely penniless, though. As he walked away, he claimed (and received) a $72.9 million tax refund due to the fact that he was declaring such massive losses. However, it seems Trump also gained 5% of the stock from the new company formed when the casinos were officially bankrupt, an illegal act. Should the IRS disallow his tax refund, he must return it with interest, and possibly penalties as well. He may also have to return state and local refunds based on that same claim. Ultimately, should Trump lose his case, it is possible he will have to pay upwards of $100 million. However, Trump has been using his team of lawyers and the Justice Department to force his case into a stalemate that was sent to the Supreme Court (who rejected it). Now, we watch to see if our President will be held accountable by the courts for his actions, or if his wealth and cult-like following will save him from having to confront his past once again.

Sources:

https://www.npr.org/2020/09/27/917566141/trump-dismisses-new-york-times-…

https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html

https://thehill.com/homenews/house/518844-gop-seeks-to-redirect-criticis…